Wills and Probate News: April 2018

Wills and Probate News: April 2018

Wills and Probate News Compiled by the Probate Bureau

Wills and probate experts in Hertfordshire, the Probate Bureau, have compiled the latest news, advice and guidance on Wills and Probate from around the world.

Why Wills Are Even More Important in a Digital World

Former US President John F Kennedy (JFK), speaking in June 1963, declared, 'change is the law of life and those who look only to the past or present are certain to miss the future'. Looking to the future and worrying about what will happen to your assets after you die is not a particularly cheerful topic. However, in accordance with the old adage, the only certainties in life are death and taxes, and it is important to give regular thought as to how your estate will be managed after your death, writes Tom Deely for Spears.com

It is perhaps human nature to associate wills with death and thus the making of a will as a consideration for later in life, to push back until one is ‘at death’s door’. However, in today’s society, early estate planning is more important than ever, as change can be so rapid and so drastic.

Take developments in computer graphics, for instance. These have led many celebrities deciding to change their wills, with the specific intention of including constraints as to the use of their digital selves after their death. Last week, the speech JFK was due to make on the day he was assassinated was reconstituted by UK special effects company, CereProc; and according to reports, Hollywood is working on ideas that feature older actors, such as Harrison Ford and Sean Connery, playing opposite digital creations of their younger selves.

The need to review your wills to address change is not limited to the celebrity sphere, however. Changes in family arrangements, where second and third marriages are more commonplace, and the increase in property prices, often result in an increase of adult children living in the family home for longer. This gives rise to a need for individuals to regularly consider how best to ensure their estate passes in accordance with their wishes.

Wills enable an individual to exercise control over how their estate is managed and administered and ensure certainty as to who is to benefit from their estate. Whilst making a will does not (and cannot) ensure that a dispute will not arise out of an estate, making a will in clear and unequivocal terms can minimise the risk of such disputes later in time.

It is also advisable to prepare a letter of wishes to accompany a will. A letter of wishes, although not binding on the executors, allows an individual to explain the reasoning behind the terms of the will and to set out their intentions in a more personal manner. This can help prevent assertions from disgruntled beneficiaries as to ‘what the deceased would have wanted’, as in estate disputes; the best witness is no longer alive.

There is no exhaustive list to ‘tick off’ when making a will. A key consideration is to factor in as many ‘what ifs’ as possible. In order to keep pace with change, and the inevitable ‘what ifs’ that arise and develop over time, it is sensible to review a will, and any testamentary intentions, on a regular basis.

Foreign Assets: Should You Try to Cover Everything in One Will?

Andrew Jones, via familylaw.co.uk, poses the question; If you own assets in more than one jurisdiction, should you try to cover everything under one will, or should you have a separate will in each jurisdiction?As our lives become more international, it has become far more common for people to own assets in more than jurisdiction. As a result, I am often asked whether the right thing to do is to have one will covering worldwide assets, or alternatively to have separate wills in each jurisdiction where there are assets. Unfortunately, the answer depends upon your circumstances. However, here are a few pointers:

For many people, the best choice is to have multiple wills.

1. A simple practical advantage to having a will in each jurisdiction is that the lawyers in both jurisdictions can get on with the process of putting the will through probate (or its local equivalent), as soon as they are aware of the death. If there is only one will then it must usually be probated in the nation where it was drawn before the courts of that nation can issue sealed and certified copy of it for use in the other nation, and only then can the process begin there. (The process I am describing here relates mostly to commonwealth countries, but there is an equivalent problem whichever type of jurisdictions are involved.)

2. The wills drawn in each jurisdiction would have been drafted by lawyers experienced in working in that jurisdiction, and therefore will be designed to be effective there. This is especially the case where estate taxes or inheritance taxes are an issue because the lawyers drawing the wills will be able to advise on how to mitigate the taxes in that local jurisdiction.

3. You get a particular problem where the two jurisdictions have different types of law. For example, the UK, most Commonwealth countries, and most states of the US are 'common law' jurisdictions, most countries in Continental Europe are 'civil law' jurisdictions and most Islamic nations are 'sharia law' jurisdictions. The provisions of a will drawn in one of these jurisdictions will not fit easily with the laws of another. A common problem, for example, is that a civil law jurisdiction (for example Spain) will not recognise the concept of trusts, while all common law wills (such as those drawn in England and Wales) are built around trusts, and indeed executorship is a kind of trust. It follows that a will drawn to be effective in England and Wales would not necessarily be effective – indeed from a tax viewpoint could be very damaging – if applied in Spain.

Advantages of a single will

1. It can be much cheaper to get a single will drawn up than to have numerous wills drawn up by several different lawyers in several different countries. (This could prove only to be a short-term advantage, however, since the administration of the estates later on might prove to be more expensive).

2. Some jurisdictions, mostly civil law jurisdictions, have a concept known as 'forced heirship' which means that a person must leave their estate to certain specified heirs rather than, as in England and Wales, to anyone who they chose. It follows that, if the local law permits it, people can achieve things through an England and Wales will which might not be possible in a will drawn in the jurisdiction itself. This is the one (and probably the only one) situation in which I would strongly recommend that a single will is better than multiple wills.

3. I have blogged previously about the EU Succession Regulation here. Put briefly, this is a law which says that someone who has assets situated in most EU nations (although not the UK, Denmark or Ireland) can elect for the law of their nationality to apply to the succession to their assets in that jurisdiction. A British person who owns a holiday home in Spain, for example, can use this provision to deal with the succession to their holiday home, and it might well be advisable for them to do that if what they want to achieve is different from the provisions that would apply under Spanish forced heirship.

4. Another factor to bear in mind, especially for simple estates, is that if there is only one will then updating it whenever something changes only involves updating one document, not several, and therefore reduces the associated costs.

5. One problem which appears obvious, but which actually we see time and time again in practice, is that multiple wills are drawn, but the wills which are signed later unintentionally revoke the ones which were signed earlier. This problem disappears where there is only a single will – and the important point where there are multiple ones is to ensure that every will that is drawn only revokes previous wills to the extent that they apply in that jurisdiction.

6. Under UK law, the law of the place where someone is domiciled applies not only to the assets situated in that place but also to 'moveable assets' (moveable assets means anything other than land and buildings) situated overseas. Where this applies, and where the overseas assets are moveable, it can be a reason to stick to only the one will. It is important, however, that this is only invoked if the other nation in question has the same rule (although most common law countries do).

Conclusion

As described above, there is no ‘one size fits all’ and professional advice should always be sought.

Alzheimer’s and the Blur Between Wills and Marriage

Family disputes about wills and inheritance are never pleasant but made worse when a relative’s mental capacity is questioned, writes Hannah Solel for Spears Wealth Management.

‘Sailing into the dark,’ was how novelist Iris Murdoch described her own degeneration – and indeed it is many people’s fear that one day the mind won’t be working but the body will. It is, of course, something that we generally prefer not to think about.

But the recent case of DMM is a reminder that one should give these matters thought – and before it’s too late. Here are the facts: when an octogenarian man diagnosed with Alzheimer’s disease expressed his intention to get married, a hostile legal dispute arose. The man’s three daughters from his first marriage contested his decision to marry his partner of 20 years, arguing that their father did not have the mental capacity to marry.

Crucially, they argued that he did not understand that marriage revokes a will – a particular quirk of the law. His will was largely in favour of his children, dividing up his £1.7 million of assets – a South-West England property, cash and art. His daughters’ great concern was this: if their father were now to die without a new will in place, then the laws of intestacy would stipulate a greater division of assets to the new wife.

‘The case highlights the important but often unknown impact that marriage has on a will. Not many people appreciate that getting married will revoke an existing will,’ says Nazia Nawaz, a senior associate in the will, trust and estate disputes team at Irwin Mitchell. ‘This was a point raised by the Law Commission in the consultation on wills and whether the law should be changed,’ she adds. The Commission is currently formulating its recommendations after its consultation period ended in November.

The case was heard in the Court of Protection, which deals with financial and welfare matters for people who lack mental capacity. Importantly, the judge had to decide whether or not the test for capacity to marry included ‘a requirement that the person should be able to understand, retain, use and weigh information as to the reasonably foreseeable consequences of a marriage, including that the marriage would automatically revoke the person’s will’.

A psychiatrist assisting the court concluded that the man understood the law on his will being revoked, that he might not be able to make a new one, and that his children would receive less than they would under his old will if he died intestate. The judge, therefore, decided: ‘I am satisfied that… [he] has at present the capacity to marry.’

The judge clarified that an understanding that marriage revokes a will is ‘information that a person should be able to understand, retain, use and weigh to have capacity to marry’. The judge explained that this was not setting the test too high for marriage, which would otherwise create ‘an unfair, unnecessary and discriminatory bar against those with capacity issues potentially denying them that which all the rest of us enjoy’.

He made clear though that this was distinct from establishing a requirement to understand the ‘financial effect’ of marriage. That, by contrast, would be ‘setting too high a standard, too refined an analysis, asking to take too many hypothetical situations into consideration’. So, though someone might not have a full understanding of the ramifications of marriage – this doesn’t prevent that person from marrying and triggering those ramifications. They just need to know that it alters the status of any existing will.

One key lesson for HNWs to take away from this case is to keep wills regularly updated, to reflect changes in financial circumstances and family life. Nawaz adds: ‘While most people are aware that divorce can have wide-ranging financial implications, it is not often that we hear about its impact on inheritance.'

Helen Quinn, a knowledge officer at Alzheimer’s Society, told Spear’s that while this case raised a number of dementia-related issues, it also highlights ‘a general lack of awareness’ in the wider society of the law on marriage revoking a will. ‘You can’t assume that someone with dementia lacks the capacity to marry and in this case, it was decided that the person had such capacity, which included the ability to understand the consequences for the will.

‘However, if marriage occurs where capacity is absent, or if there is a forced marriage, the rule that marriage revokes a will, combined with the intestacy rules, does present opportunities for financial abuse.’

Alzheimer’s Society monitors the issues affecting people with dementia through its national helpline and network of local support. 'It can be difficult to know how widespread particular types of financial abuse are as the statistics recorded by local authorities are quite generic,’ Quinn explains. ‘Any financial abuse is unacceptable and in appropriate circumstances, it may be necessary to involve the local authority safeguarding team and/or the police.’

Doubts about mental capacity where high-value inheritances are at stake will continue to arise. This is the result of an ageing population, with more and more suffering from dementia – Alzheimer’s Society estimates the numbers will rise to more than one million by 2025. While in this particular dispute the daughters chose not to appeal to the Court of Appeal, the case serves as an important reminder of the need to keep your will updated, as a safeguard against disputes.

The Probate Bureau is the UK’s longest established experts in Wills and Probate. Probate Bureau offers a unique blend of bespoke legal and financial solutions to families at a very difficult time. We offer a fixed fee solution to the legal minefield that can accompany the administrative responsibility of executing a Will. Call for advice or to arrange a consultation.

Back To BlogShare This Post

Recent posts

- When Do You Need Probate & When Is It Required? By The Probate Bureau , 26/07/2023

- Losing a Loved One at Christmas By Probate Bureau , 16/12/2020

- Probate - Your Questions Answered By Probate Bureau , 01/09/2020

2015 Archive

2016 Archive

2018 Archive

2019 Archive

2020 Archive

0 Archive

- December 1 posts

2023 Archive

- July 8 posts

Blog Categories

Find your way through the probate maze

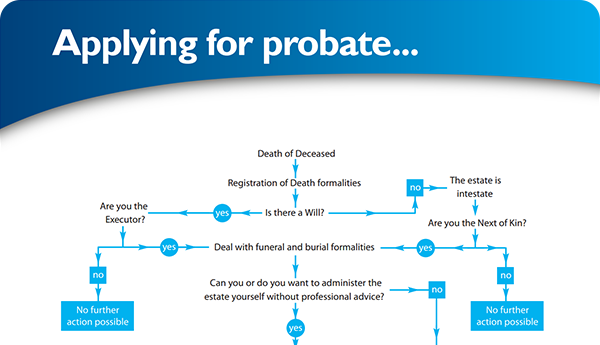

Click here to follow our step-by–step probate process guide

×