How To Choose Guardians For Your Children in a Will

How To Choose Guardians For Your Children in a Will

It’s hard to imagine a time when you can’t look after your children, especially when you have to think of someone else raising them. Though, if something happened to you and your partner, of course, you’d like to make sure your little ones were in the very best hands and with someone you trust. This is why we urge parents to make a will and pick a legal guardian for their children.

This may feel a bit morbid, particularly if you have just had a baby and are enjoying being a new parent, but once you fully understand what a Will can do to protect your children, making a Will could shoot to the top of your to-do list.

Why is it important to choose a guardian in your Will?

One of the most important reasons to make a Will if you have children is so that you can name a legal guardian to have responsibility for them. Having a say over who will look after your children if you die means that you feel more at ease about their future care and welfare. However as this is such a critical decision to make, it is important that you really give it some thought.

Things to Consider When Choosing a Guardian:

Don’t Automatically Go for a Twosome:

Many parents tend to gravitate towards a married couple when choosing a guardian for their children. It’s a common assumption that a married pair will seem more stable than a single. Though it’s important to think carefully. Divorce can happen to even the best of couples, so you may want to choose one person instead, or choose ahead of time which person would look after your child, in the event of the couple splitting. It’s also important to keep in mind if the couple already has children. Will your child fit well into the family or get lost in the shuffle?

Consider Values:

Does your family live by certain values, or do you want them to be raised into a certain religion? Then faith may be an important thing to consider when it comes to picking a guardian. It’s also important to consider your potential guardian’s morals, educational views and parenting style – make sure this matches your own.Don't Rule Out Far-Flung Relatives:

Think about where your potential guardian lives and how much a potential move to another city, county or even country would change your child’s life and day to day routines. Think about how your child would cope with that, it may seem like a horribly disruptive thing to do, but if the best person for the job lives elsewhere, it may be better in the long run.

Take into Account the Health and Age of the Guardian:

You may have your heart set on selecting your parents (child’s grandparents), but they may just be too old to run around after a toddler or handle the demands of a teen. Think about whether they can fulfil this or whether it would be better to designate a guardian for a specific length of time, and then designate another until your child turns 18.

Figure in Finance and Family Factors:

Think about this; does your potential guardian own a home, have a steady job, or work in a field that requires a lot of travelling? All these factors need to be weighed up. You may think it’s a good idea to have your child live with your sister at the other end of the country, but if she’s always moving around and changing her job, it may be better to consider someone a little more geographically secure to ensure your child has some stability.

Split the Task Up:

Some parents load their child’s guardian with the task of taking care of finances and their child’s inheritance. After all, it can be very tempting to ask the same person to take care of both these jobs, as they will be the closest to the child. Though, if the guardian doesn’t have a good head for money, you’ll need to find a second person for this task. Maybe you could choose a responsible grandparent to be the executor, whilst your cousin raises your child, to ensure they make the most of the money you leave and make sensible decisions.

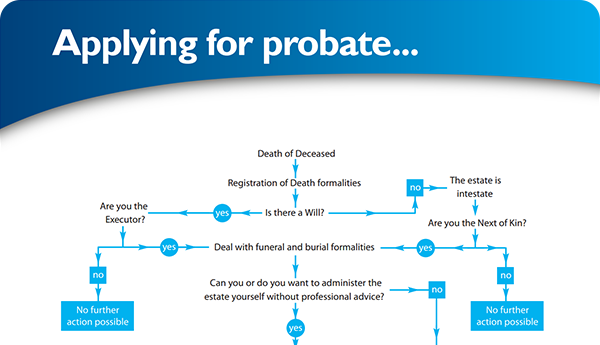

Our Ethos Here at The Probate Bureau

Here at The Probate Bureau, our main aim is to be able to save families time, money and stress in tough times. We are able to shoulder the whole burden of winding up an estate from paying the funeral director to getting the final inland revenue clearance. We provide the best service at a very fair and reasonable fixed fee and we are able to administer most of our estates within 6 months by our highly efficient and qualified team.

Over the years we have found that people really do appreciate a free non-obligatory meeting in their own home where all their concerns and questions can be fully answered. We don’t have any paid consultants, nor do we pay out or receive any commissions from anyone. We are proud to be the longest running specialist probate firm in the UK, recommended by over 1000 independent funeral directors, so we have earned a high degree of trust. We also have many professional associations allowing us to forward professional discounts on to the families who instruct us – it is always our aim to help families retain more of its inheritance.

Please feel free to give us a call on 0808 256 2366 to check out what you should do, and more importantly what you shouldn’t do. Before you do anything else call The Probate Bureau – the most professional, reliable probate service in Hertfordshire.

Back To BlogShare This Post

Recent posts

- When Do You Need Probate & When Is It Required? By The Probate Bureau , 26/07/2023

- Losing a Loved One at Christmas By Probate Bureau , 16/12/2020

- Probate - Your Questions Answered By Probate Bureau , 01/09/2020

2015 Archive

2016 Archive

2018 Archive

2019 Archive

2020 Archive

0 Archive

- December 1 posts

2023 Archive

- July 8 posts

Blog Categories

Find your way through the probate maze

Click here to follow our step-by–step probate process guide

×