Probate Solicitors Southend-On-Sea

Probate Solicitors Southend-On-Sea

When a loved one dies, it can be a very steep learning curve, and learning to deal with the grief and pick up your life again can be incredibly tough. During this time, your focus may be on grieving and it can be very easy to find yourself with a mountain of paperwork and affairs that need to be put in order.

You'll find that in order to complete the probate process, there is a lot of legal, tax and estate administration work required. If you end up choosing to do probate yourself with a DIY method, you could be found financially responsible for any mistakes made. This is just one of the many reasons why many people choose to use our probate solicitors. We understand from our many years of experience in the probate industry, that not everyone can cope with the death of a loved one and it may be too much of an emotional strain to carry out the Probate work personally.

That’s why here at the Probate Bureau, we are able to shoulder the whole burden of winding up an estate in the most empathetic way – providing the best service at a very fair and reasonable fixed fee price. It is our goal to save families money and to administer estates in sometimes half the time and half the cost of most other providers. If you're in need of some help, be sure to give us a call on 0808 256 2366.

Is Probate Required?

Probate is usually required if there is property, land or shares in the estate but probate may not be needed if the estate is below a certain value or being passed on to the surviving spouse and was in joint names.

Sometimes, when you're trying to find out if you need probate, it can help to make a list of what was owned in the name of the person who has died. Here’s a handy list of a few things to think about:

- Did this person have a bank account solely in their name? How much was in it?

Most banks will release all funds without a grant of probate if there is less than £5,000 in an account, though some will release up to £25,000. Really, the amount released will depend on the bank. Though, you'll need a grant of probate before you can access any money beyond the bank’s stated threshold.

- Did they own property?

If the person who died was the only named tenant on their mortgage, you will require a grant of probate before you can claim, transfer or sell the property. You'll also need to consider what the property is worth and whether there’s an outstanding balance on the mortgage.

- Did they own any stocks and shares?

Much like banks, registrars usually have a maximum threshold on the value of stocks and shares that can be accessed without a grant of probate. This can be up to £10,000.

You'll find that most financial institutions will request a grant of probate before they release any funds or stocks over a very certain amount or value, and this amount will vary depending on the bank or company.

Any jointly owned assets, like a joint bank account or a mortgage with multiple tenants, work slightly differently, and may not be subject to probate in the same way.

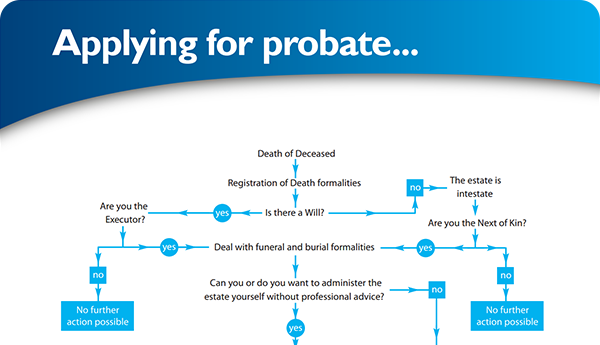

Who Can Apply for Probate?

If there is a will, the person named as the executor of the estate should be the one to apply for a grant of probate.

If there is not an existing will, a close adult relative can apply for a letter of administration, which will grant them the same rights as a grant of probate would. They are then known as the administrator of the estate.

Probate is a time and labour-intensive process, so that is why so many people choose to work with professionals to apply for probate and settle the estate on their behalf. To find out more about our process take a look here.

How To Get a Grant of Probate

To get the grant of probate, you or your representative will need to fill out the Probate application form (form PA1 in England, Northern Ireland and Wales, C1 for confirmation in Scotland), which can be downloaded or requested from your nearest probate registry. You’ll also need to fill out an inheritance tax form, even if you think no Inheritance Tax is owed.

These forms should be sent to the local probate registry, along with:

- An official copy of the death certificate

- The original will and three copies, including all official additions or changes

- The application fee of £215, unless the estate is valued under £5000

The probate registry will then send an oath, which you will need to swear either at your local probate office or at a local commissioner for oaths. Once you’ve done all of this, you should receive the grant of probate within two to five weeks. If it’s refused, the probate office will write to you to tell you why this has happened.

What About if There's No Will?

Applying for probate without a will is broadly the same process as applying for probate when there is a will. The difference is that since there is no executor, a close-relative needs to be the one who applies for permission to administer the estate.

Once they have it, they’ll be given a letter of administration, which serves the same purpose as a grant of probate. The estate will also need to be settled according to intestacy law, rather than the wishes stated in a will.

What Will Happen Once I Have Been Granted Probate?

Once you have been granted probate or have a letter of administration, you’ll be able to access all the assets, pay any debts and taxes owed, and carry out the other terms of the will.

Need Help Applying for Probate? Talk To The Probate Bureau

Here at the Probate Bureau, we offer a range of fair and reasonable, fixed-fee probate services in Southend-On-Sea. Whether you need help with probate administration, writing a will or need advice about finances, we’ll be able to help.

Though, if you are looking to handle probate yourself, before you do anything else, be sure to take a look at our 7-step checklist. It will help you through the process and highlight some warnings you may encounter on the way.

For some advice, please feel free to call us on 0808 256 2366. We’ll never treat you like one more number. Each and every one of our clients is unique and all of us are completely trained to take care of you exactly how we wish to be treated ourselves. We’ll be able to tell you what you should do, and even more importantly, everything you shouldn’t do before you do anything else. The Probate Bureau – professional probate solicitors in Southend-On-Sea.

Back To BlogShare This Post

Recent posts

- When Do You Need Probate & When Is It Required? By The Probate Bureau , 26/07/2023

- Losing a Loved One at Christmas By Probate Bureau , 16/12/2020

- Probate - Your Questions Answered By Probate Bureau , 01/09/2020

2015 Archive

2016 Archive

2018 Archive

2019 Archive

2020 Archive

0 Archive

- December 1 posts

2023 Archive

- July 8 posts

Blog Categories

Find your way through the probate maze

Click here to follow our step-by–step probate process guide

×