Expert Trusts, Powers of Attorney & Wills in Hertfordshire

Prevention is better than cure. Apart from administering estates, we also have an in-house Will & Trust Department. We are able to offer you a free appointment in your home to discuss the drafting of a Will, protective Trust or Lasting Power of Attorney ("LPA").

Contact The Probate Bureau today to discuss your circumstances.

Why do I need a Will?

Everybody over the age of 18 who has assets they want to protect should make a Will. The consequences of not doing so are that your estate will be distributed in accordance with government guidelines known as the Rules of Intestacy. This means you have no say whatsoever in who will receive your estate. Our Will writing department can advise you on drafting a Will that best suits your interests.

Having a Will is particularly important if you have children under the age of 18. If you die intestate (without a Will) and are a single parent, the absence of a Will means that the Local Authority will decide who has guardianship of your children. This could be a close relative, a distant relative or a local care home. Whereas if you make a Will, you can stipulate to whom you wish to entrust the care of your children; as well as making suitable financial provision for their future.

Another issue that can be dealt with is the Inheritance Tax (IHT) bill due on your death. If your estate is valued at over the current Inheritance Tax threshold (£325,000) then you should seek advice immediately on how you can reduce IHT payable; this could be through your Will, trust work or estate planning in conjunction with our sister company The Probate Bureau Financial Services Ltd.

We often see poorly drafted Wills which do not fulfill their intended purpose, as well as Wills which have been made invalid through lack of legal knowledge. Even worse is the complete absence of a Will in estates where the deceased had no immediate Next of Kin. In these cases the estate often gets distributed between distant relatives such as nephews and nieces or cousins, when those closest to the deceased know that this is not what they would have wanted.

We are members of the Institute of Professional Willwriters and approved by Trading Standards so you can be assured that you will receive professional, reliable advice.

Trusts

A trust is like an imaginary box set up by a 'Settlor' into which assets are placed. 'Trustees' hold the 'key' to this box and have strict instructions as to whom gets what and when. The only people that can benefit from the assets within this 'box' are the 'Beneficiaries' and they can be one and the same as the Trustees. A Will is in effect a trust, that is; somebody has been entrusted to ensure "the right assets get to the right hands at the right time".

Setting up a Trust can be a fantastic way of safeguarding assets and potentially saving future Inheritance Tax and keeping other "undesireables" out of an asset's reach. Used for a number of reasons, they protect assets and enable you to pass money or property to others, whilst you are still alive. Trusts can be set up as part of a Will as well. This is a highly specialised field and great care needs to be taken not to buy trusts 'off the shelf' from cold-calling salesfolk. Moreover, with the phasing in of the new Property Nil Rate Band ('PNRB') in 2017, extra care is required to ensure you don't end up paying more in tax! If you are in any doubt at all, give us a call.

Lasting Powers of Attorney ("LPAs")

Under the Mental Capacity Act 2005, individuals can now draw up a LPA in England & Wales. Prior to this there were Enduring Powers of Attorney ("EPAs"). LPAs are documents that enable individuals (known as a Donors) to appoint "Attorneys" to look after their affairs in the event of mental and/or physical incapacity. It is essential that such arrangements are made while fit and healthy since the Law does not allow such arrangements to be made after the event. Without a LPA, families are often left with a multitude of practical problems and it can be very expensive and frustrating to obtain a Deputyship Order from The Office of the Public Guardian ("OPG").

LPAs can be drawn up to cover the management of financial affairs (a Property & Financial Affairs LPA) and the management of personal matters such as medical care (a Health and Welfare LPA). Unlike in Scotland, a single document to cover both aspects is not allowed. Whilst LPAs are very powerful documents, there are numerous safeguards to prevent their abuse:

An LPA is primarily used to appoint a person to deal with your affairs after the onset of mental and/or physical incapacity. However before the document can be used, certain people (including the Donor), who were selected by the Donor when drafting the LPA, have to be notified and anyone can object if they are not happy with the reasons why the document is being brought into effect. Restrictions can be included on what the attorneys can and cannot do under the authority of the documents and advice or guidance can be included by the Donor about how they would like the Attorney(s) to act.

When the LPA is signed, a certificate must be completed by a professional or someone who has known the donor for at least two years to confirm that the person making the document understands the meaning of the LPA and the consequences of it. Like your Will, a LPA can be updated or cancelled at any time should circumstances change (as long as you have the capacity to do so).

TRY THIS HANDY GUIDE TO SEE WHO INHERITS WHEN THERE'S NO WILL.

Let us guide you through the most recent (and often misunderstood) Rules of Intestacy by answering the questions below. If you get stuck at any point, or don't know how to answer, just give us a call and we can tell you definitively who is to inherit in any given situation.Stuck or confused? Get in touch at 0800 028 2837, or use the callback form below and we will contact you.

Request callback

We recieved your callback request. Will be contact you soon

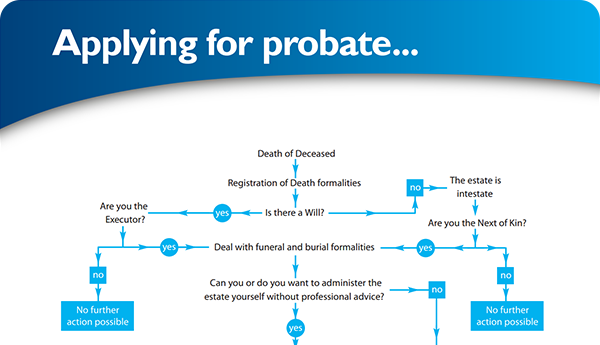

×Find your way through the probate maze

Click here to follow our step-by–step probate process guide

×