Terms & Conditions

ESTATE ADMINISTRATION

1. TERMS AND CONDITIONS OF APPOINTMENT

1.1 Although the Directors of The Probate Bureau Limited ("the Company") are personally appointed as executors, administrators or trustees, the actual administration of the estate or trust will be carried out on behalf of the Directors, by and in the name of The Probate Bureau Limited.

1.2 The Directors of the Company will act as Personal Representative of a deceased person’s estate (an ‘Estate’) or as Trustee of any Inter Vivos Trust or Will Trust (a ‘Trust’), either solely or jointly on the terms and conditions set out herein.

1.3 The Company shall be entitled to remuneration (free of all deductions as set out below) which shall be a first charge on the Estate or Trust in accordance with the fee agreed by the instructing client (‘the Instructing Client’) either as a fixed sum fee or as a percentage divisor of the estate as set out herein below at Clause 2.1 hereof.

1.4 The Company may in its absolute discretion employ any such firm or company, to perform any services on behalf of the Estate or Trust on such terms and conditions as the company may, from time to time in its absolute discretion, determine.

1.5 Whether the Company acts as sole Personal Representative or Trustee or acts jointly as such, with another person or persons, all money; securities; Title Deeds; and documents relating to the Estate shall be in the exclusive custody or under the exclusive control of the Company or its nominees but that other person or persons shall have proper facilities for inspection.

1.6 Where any business is included in the assets of any Estate or Trust the Company will not, unless expressly authorised by the Will or other trust instrument, normally carry on the business longer than is necessary for the sale, winding up or other disposition of the same and then only on the condition that it shall be fully indemnified against all costs, expenses and losses out of the assets of the Estate or Trust

1.7 All administration fees and expenses due to the company or its agents arising from the administration of the Estate or Trust shall be deducted from the residuary estate before final distribution to the beneficiary or beneficiaries thereof and if sufficient funds are unavailable from the residuary estate then the person or persons named overleaf shall be solely, or jointly and severally liable for any shortfall which shall be paid to the Company within seven days of receipt of the final invoice of the Company for its services.

1.8 This appointment by the Instructing Client of the Company to act in the administration of the estate named overleaf in the agreement hereof (‘the Agreement’) may be revoked at any time in writing by the said Instructing Client within seven days of the date of the Agreement hereof and if such revocation of appointment is received within the aforesaid period of seven days then all documentation received by the Company will be returned upon receipt of cleared funds to cover disbursements and any reasonable expenses incurred by the Company during this initial seven day period.

1.9 If any revocation of appointment is received after the first seven day period as aforesaid then the Company is entitled to charge its minimum fee as stated at Clause 2.1 hereof save in instances where a Grant of Representation has already either been applied for or secured then in such instances the full agreed fee and disbursements shall be charged and shall become payable within seven days upon submission of the final invoice of the Company to the Instructing Client.

2. SCALE OF REMUNERATION

2.1 Save in circumstances where the agreed fee for the administration of an estate by the Company is expressed as a fixed sum then a fee calculated on the basis of 3.5% of the gross value of the estate determined by the IHT205 or IHT400 return inclusive of all gifts with the reservation of benefit and potentially exempt transfers subject to a minimum fee of £3,500 plus VAT thereon.

(i) The calculation of that part of the fee attributable to a private residence formally occupied by the deceased which is transferred to a beneficiary who resided with the deceased or is retained in Trust for the occupation of such a beneficiary will be reduced by bringing into charge only one half of its value.

(ii) The Inheritance Tax ("IHT") apportionment value of assets in the joint names of the deceased and any other person(s) passing absolutely to the survivor(s) by right of survivorship will be included in the gross value of the estate for the purpose of this fee in accordance with the percentage share of the beneficial interest held by the deceased as of the date of death and declared as such on the IHT return.

(iii) This fee will be treated as an administration expense to the Estate and will be deducted from the Estate prior to any distribution of the Estate to any beneficiary or beneficiaries.

(iv) Assets held in trust (e.g. pension death in service benefits) which do not form part of the gross estate for IHT purposes but may be administrated wholly or in part by the Company will be included in the gross value of the estate for the purpose of this fee.

(v) Assets held outside of the jurisdiction do not form part of the administration of the estate by the Company save for the inclusion of valuations for the purposes IHT calculation. If any such asset was held by the deceased then it is incumbent upon the Instructing Client to secure the appropriate legal advice from a qualified Attorney within the jurisdiction on matters such as disposal by sale or the transfer of title by inheritance.

(vi) The cost of petty disbursements such as standard postage, national telephone calls and stationery is included in the Company's fees.

2.2 The ability of the Company to charge a fixed rate fee for the administration of an estate is predicated on a reasonable and proportionate level of contact with the Instructing Client at key stages of the administration to keep the same fully informed of developments. For this reason, information pertaining to the estate will not be disclosed to or discussed with any other beneficiary other than at the complete discretion of the Company. In the event that the demands of an Instructing Client for information becomes excessive or disproportionate then the Company reserves the right to levy charges at the rate of £200 per hour plus VAT on a pro rata basis for each and every attendance upon the Instructing Client once written notification has been served upon the same.

2.3 The Company will levy additional charges for work that does not form part of the standard administration of an estate such as compliance with a Department for Works and Pensions investigation into the financial affairs of a deceased (£500 plus VAT); the completion and submission of Self Assessment Tax returns (£400 plus VAT for each tax year); Affidavits required by the District Probate Registry to address issues of due attestation, plight and condition etc (£350 plus VAT inclusive of legal fees) and HMRC investigations into the assets of the estate including those involving the District Valuer (£600 plus VAT). Other non standard work will be charged in accordance with the complexity and time taken to deal with the issue. The Instructing Client will be duly notified of any such additional charges aforesaid.

3. QUALITY ASSURANCE

The Company will endeavour to conduct the administration of the estate both efficiently and effectively in accordance with the highest standards of professional practice. All monies called in during the administration are retained in our client account that is maintained entirely separate from the finances of the Company and administered in strict compliance with the standards set by the Solicitors Accounts Rules as per the Code of Conduct of the IPW.

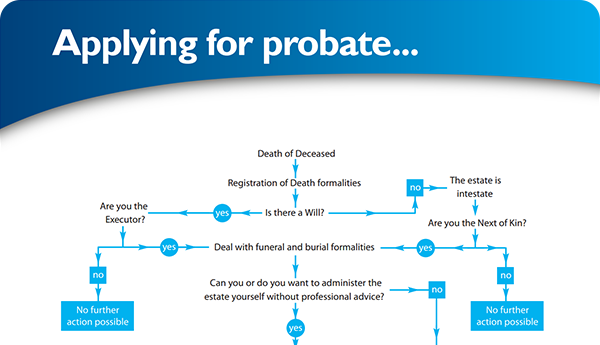

Find your way through the probate maze

Click here to follow our step-by–step probate process guide

Testimonials

Excellent service, everything went very smoothly. Like to thank Ann and her team.... read more

- L. NormanGood & Reliable service, always kept up to date with what was happening. Value for money.... read more

- R.W. SimmonsLatest Tweet

Follow @ProbateBureau

Contact Us

0800 028 2837 info@probatebureau.comTHE PROBATE BUREAU

3 Crane Mead Business Park

Crane Mead

Ware

Hertfordshire

SG12 9PZ

×