Fixed Fee Probate in Hertfordshire

Winding up an estate can be an onerous task. We provide comprehensive explanations on the whole process; the legalities, forms, tax implications and much more. We know what you are facing and want to help. Here are some of the main issues to consider.

Contact The Probate Bureau today to discuss your circumstances.

How Much Does Probate Administration in Hertfordshire Cost?

It is vitally important to understand that there are several stages involved in the administration of an estate. Quotations can be very misleading because it depends which stages are being quoted for. It is not unusual to pay £2,000 plus VAT for a solicitor to just get a Grant of Representation for you and then charge you hundreds of pounds per hour to complete the full administration of the estate. We can deal with one or all of the stages with clearly defined fixed fees.

Our minimum fee for obtaining a Grant of Representation on your behalf is £950.00 plus VAT. Click here to see if you are eligible for this service.

If, however, you want us to administer the whole estate from start to finish, from obtaining a Grant of Representation right through to final distribution and Inland Revenue clearance, give us a call on 0800 028 2837 or complete our online enquiry form by clicking here.

How Long Does The Process Take?

The Probate Bureau prides itself on how quickly it administers estates. In our experience, a modest estate with no property to sell, can be fully completed within 3-6 months. Estates with property or inheritance tax issues or disputes may take longer. You may have heard of the expression the 'executor year'. It is often used to indicate that a year is considered to be a reasonable time in which to administer an estate. We consider that to be excessive in most cases. When The Probate Bureau was set up it set a standard - to be be half the price and twice as quick as the 'old school' practioners. We continue to live up to that standard with no loss of quality.

Please beware, there are many large probate practitioners out there taking well in excess of a year to administer modest estates charging more than we do! You may wish to look at our blog page for some review site links.

The 7 Step Checklist

Even a simple estate can take many hours to complete. There are many legal and financial disciplines involved in any administration. If you instruct us to handle everything you will have peace of mind knowing that all the 't's are crossed and all the 'i's are dotted at a set fee. Click here to view a comprehensive list of what's covered in our fee.

If you are looking to handle probate yourself, before you do anything else, click here to download our 7 Step Checklist. It will help you through the process and highlight some warnings on the way.

House Clearance and De-cluttering

The Probate Bureau is able to help in many cases where people need to move house and dispose of chattels. When a person is downsizing or moving into residential care, the family can find it a very onerous task, especially when family members live far away. The Probate Bureau can offer a comprehensive house clearance, property sale and conveyance service to the individual moving and his or her family. Please contact us for further details.

Sale of Cars and other such Assets

Whether you are an Executor or the next of kin seeking information and support regarding an estate, do not hesitate to call our qualified team. We have many professional links to assist with a multitude of related services from the valuation and sale of assets to home staging and tax saving. Most people are unaware of how much is involved with winding up an estate.

More Complex Probate Cases

If an estate is over £325,000, if there are foreign assets, a missing Will or missing assets, missing beneficiaries or disputes of any kind, the administration of an estate is far more complicated than you think. Because we are probate professionals, we have naturally evolved over the years to incorporate more specialised areas of expertise; all of which is focussed on helping you with the more complex issues involved with winding up an estate.

In less than a generation we have experienced in the UK an ageing population, a breakdown of the traditional family unit and the movement of peoples across boarders like never before. This has created new challenges for us with disputes over estates and missing beneficiaries. On top of this, legislation is constantly changing. If you have administered an estate in the past you may find the process very different now. Just take a look at the tax forms ('Form IHT400') you are required to complete if a single person's estate is over £325,000.

It is only once the tax has been dealt with that a grant can be applied for and, according to a recent statement by one Probate Office, one third of all applications by solicitors are returned due to errors! It is always good advice to employ someone who knows what they are doing. Call us now if you are unsure about any aspect of administering an estate.

Inheritance Tax & Capital Gains Tax

We can't stress strongly enough how important it is to get professional advice in this matter. Over the decades we have experienced countless cases where someone has attempted probate themselves, thinking that they are saving legal fees, only to pay far more than the professional fees in tax. With The Probate Bureau it costs you nothing to find out what the tax implications are. Remember, it is what you are left with at the end of the process that counts; it is not unusual to find that for every £1,000 in fees £10,000 of your inheritance is saved. Working in tandem with TPB Wealth Management, we can ensure you get the very best legal and financial advice all under one roof.

Heir Hunting (Tracing Missing Beneficiaries)

In recent years there has been a greater amount of interest in heir hunting or heir tracing, with programmes such as “Heir Hunters” and even “Who Do You Think You Are”. We have successfully traced many beneficiaries with the help of our associated heir hunting team and millions of pounds have now been distributed to the rightful heirs.

Where no immediate Next of Kin are traceable on the death of an individual, The Government Legal Department (formally The Treasury Solicitor) will advertise what is called a Bona Vacantia estate which will be open to any heir-hunter wishing to locate missing beneficiaries for a percentage of the estate. Unfortunately the estate values are not broadcast, so in most cases the heir-hunters reap nothing at all for their efforts.

One case we dealt with recently resulted in a grant being issued within 6 months of the date of death! Our report ran to some 60 pages with 37 family trees going back as far as 1793 and relatives being located in Western Australia. We are proud of our team’s ability to locate missing beneficiaries quickly and with minimal cost. Please contact us if you are aware of anyone who has recently passed away with no immediate relatives to speak of and we may be able to assist.

Contentious Probate and Will Disputes

This is a highly specialised area. If you feel you have been cheated out of an inheritance or are suspicious about how an estate is being handled or distributed, call us today. If we can't sort out the problem we have great relationships with the best lawyers in the country. The average individual inheritance in the South East in excess of £100,000 and since there has been an increase in fraud due to people winding up estates themselves, you can't afford not to get sound legal guidance.

Family disputes are on the increase. In the next 15-20 years there are going to be unprecedented levels of inherited wealth with the post-war baby boom generation looking to leave assets to their children. It is never too early to plan; and we at The Probate Bureau are only too aware of the problems that can be caused by poorly drafted Wills or absent Wills. The cost of fighting a contested probate through the courts can easily exceed £100,000, which is why mediation has never been more appropriate. The Probate Bureau can help with dispute mediation, settling cases outside of court as well as full blown litigation.

TRY THIS HANDY GUIDE TO SEE WHO INHERITS WHEN THERE'S NO WILL.

Let us guide you through the most recent (and often misunderstood) Rules of Intestacy by answering the questions below. If you get stuck at any point, or don't know how to answer, just give us a call and we can tell you definitively who is to inherit in any given situation.Stuck or confused? Get in touch at 0800 028 2837, or use the callback form below and we will contact you.

Request callback

We recieved your callback request. Will be contact you soon

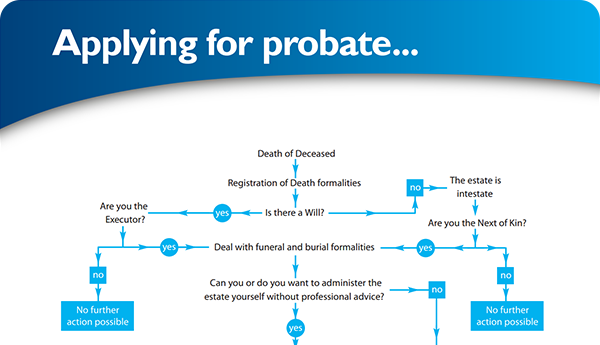

×Find your way through the probate maze

Click here to follow our step-by–step probate process guide

×