DIY Probate vs Professional Help

DIY Probate vs Professional Help: Making the Right Choice for Your Family's Estate

When a loved one passes away, dealing with their estate becomes an unavoidable responsibility during an already challenging time. The question many families face is whether to navigate the probate process independently or seek professional guidance. At The Probate Bureau, we understand this dilemma and help families make informed decisions that protect their interests while honouring their loved one's wishes.

Understanding the Probate Process and Your Options

What Probate Really Involves

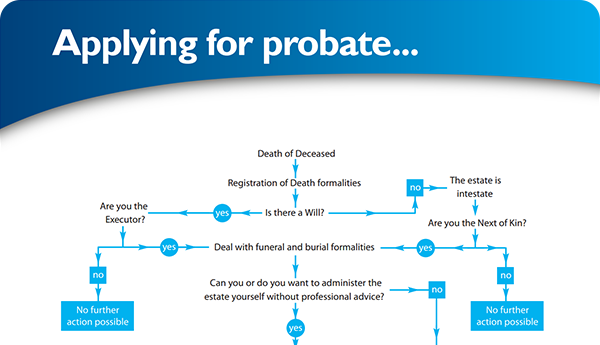

Probate represents the legal framework for administering a deceased person's estate. This comprehensive process encompasses validating the will, collecting assets, settling outstanding debts, and distributing inheritances to rightful beneficiaries. When no will exists, intestacy rules govern the estate distribution, often creating additional complexity.

The process extends far beyond simple paperwork completion. Estates involving property portfolios, investment accounts, or inheritance tax liabilities demand meticulous attention to legal requirements and strict adherence to statutory deadlines. A single oversight can result in significant delays, financial penalties, or personal liability for the executor.

Understanding these responsibilities early helps families assess whether they possess the expertise, time, and emotional capacity to manage probate independently or whether professional support would better serve their circumstances.

The DIY Probate Approach: Benefits and Risks

Benefits of DIY Probate:

- Allows families to minimise legal expenses

- Government provides online guidance and standardised forms

- Can be a viable option for simple estates with minimal assets and clear beneficiary arrangements

Risks of DIY Probate:

- Executors bear personal liability for incorrect estate distribution, missed creditor claims, or procedural errors

- Mistakes can lead to significant financial consequences, family disputes, and prolonged estate administration

- Complexity increases with foreign assets, business interests, multiple properties, or inheritance tax implications

- Navigating these situations without professional expertise can be overwhelming and counterproductive

When Professional Probate Services Provide Essential Value

Recognising Complex Estate Scenarios

Professional probate services become invaluable when dealing with sophisticated estate structures. Solicitors and specialist probate practitioners possess the expertise to handle inheritance tax calculations, property valuations, business asset transfers, and international estate components that frequently overwhelm inexperienced executors.

Complex scenarios requiring professional intervention include estates exceeding inheritance tax thresholds, multiple beneficiary arrangements, contested wills, intestate deaths, and situations involving family disputes. Professional practitioners also provide essential support when dealing with HM Revenue & Customs, the Probate Registry, and various financial institutions.

The investment in professional services often proves cost-effective when considering the potential consequences of errors, delays, or legal complications that can arise from inexperienced estate administration.

Professional Protection and Peace of Mind

Qualified probate practitioners carry professional indemnity insurance, protecting executors and beneficiaries against potential errors or omissions. This coverage provides essential security that DIY approaches cannot match, offering financial protection and professional accountability throughout the process.

Professional services extend beyond technical expertise to include emotional support during difficult periods. Experienced practitioners understand the stress families experience and provide compassionate guidance that helps navigate both legal requirements and family dynamics effectively.

Comprehensive Estate Planning: Beyond Probate Administration

The Importance of Wills and Powers of Attorney

Effective estate planning encompasses more than probate preparation. Valid wills ensure your intentions are clearly documented and legally enforceable, significantly simplifying the probate process for your beneficiaries. Without proper will preparation, estates become subject to intestacy rules that may not reflect your actual wishes.

Powers of Attorney provide equally crucial protection, enabling trusted individuals to manage your affairs if you lose capacity to make decisions independently. These documents cover both financial management and healthcare decisions, offering comprehensive protection for yourself and clarity for your family during challenging circumstances.

Professional estate planning services help ensure these documents are properly drafted, legally compliant, and regularly updated to reflect changing circumstances, family structures, and legislative requirements.

Facilitating Family Conversations About Inheritance

Discussing inheritance planning with family members, while often uncomfortable, provides tremendous benefits for everyone involved. Open conversations about your estate plans, will provisions, and appointed representatives reduce uncertainty, prevent misunderstandings, and offer reassurance during emotionally difficult periods.

These discussions help family members understand your intentions, prepare for their potential responsibilities, and recognise when professional assistance might prove beneficial. Transparency in estate planning frequently prevents disputes and ensures smoother probate administration when the time comes.

Professional estate planners can facilitate these conversations, providing neutral guidance that helps families navigate sensitive topics constructively and comprehensively.

Making Your Probate Decision: Factors to Consider

Assessing Your Specific Circumstances

The decision between DIY and professional probate assistance depends on multiple factors including estate complexity, family dynamics, available time, and personal expertise. Simple estates with clear beneficiary arrangements and minimal assets may suit DIY approaches for confident, detail-oriented individuals.

DIY Probate:

- Suitable for simple estates with clear beneficiary arrangements and minimal assets

- Best for confident, detail-oriented individuals

Professional Probate Assistance:

- Recommended for most estates, even for an initial consultation

- Helps identify potential complications and ensure proper procedure compliance

- Provides specialist expertise when needed

Considerations:

- Factor in emotional capacity and practical considerations

- Grief can affect decision-making and attention to detail, making professional support valuable, even for simple estates

Professional Support When You Need It Most

At The Probate Bureau, we specialise in providing tailored probate support that matches your specific needs and circumstances. Our experienced team understands that every family situation is unique, offering flexible services from full estate administration to targeted consultation and guidance.

For personalised guidance on probate, wills, powers of attorney, and estate planning, visit https://www.probatebureau.com/ to speak with our friendly team about how we can support your family's specific needs.

Back To BlogShare This Post

Recent posts

- Making a Will at Christmas: Why the Holidays Are the Right Time By Admin , 23/12/2025

- Do You Need a Solicitor for Probate? By Admin , 23/12/2025

- 10 Legal Ways to Reduce Inheritance Tax in the UK (2026 Guide) By Admin , 27/11/2025

2015 Archive

2016 Archive

2018 Archive

2019 Archive

2020 Archive

0 Archive

- December 2 posts

2023 Archive

- July 10 posts

Blog Categories

Find your way through the probate maze

Click here to follow our step-by–step probate process guide

×