Comprehensive Solutions by Solicitors

Wills & Estate Planning: Comprehensive Solutions by Solicitors

When it comes to safeguarding your family’s future, making a will and creating a sound estate plan are two of the most important steps you can take. A will sets out who should inherit your assets and who will carry out your wishes after your death. Estate planning goes further, covering tax planning, trusts, and powers of attorney to protect you and your family during your lifetime as well as after.

Despite how important these arrangements are, many people in Hertfordshire either delay them or attempt to handle them on their own with the help of online templates. While DIY wills or probate may seem cost-effective, the risks of mistakes are high, and the consequences can be expensive, stressful, and time-consuming.

This guide explains why working with wills solicitors in Ware provides essential protection, the difference between DIY and professional estate planning, the typical costs involved, and how to make the right decision for your family.

Why a Will is Essential

A will is more than a document. It is a guarantee that your wishes will be respected and that your loved ones will avoid uncertainty after your death. Without a valid will, intestacy rules decide who inherits. This can lead to outcomes that you may never have intended, such as estranged relatives inheriting instead of close friends or unmarried partners.

A will allows you to:

- Appoint executors to administer your estate.

- Name guardians for children under 18.

- Specify how money, property, and personal possessions should be distributed.

- Protect vulnerable beneficiaries through the use of trusts.

- Leave charitable gifts that matter to you.

By failing to make a valid will, families often face disputes, delays, and additional legal costs that could have been avoided with proper planning.

The Bigger Picture: Estate Planning

Estate planning is about more than deciding who inherits. It also ensures that your estate is managed efficiently, your tax liabilities are minimised, and your family is protected. Solicitors offering estate planning in Ware usually provide:

- Inheritance Tax Planning – Strategies to reduce the tax burden, including exemptions, reliefs, and lifetime gifting.

- Trusts – Legal structures to protect family wealth, provide for children, or manage assets for vulnerable beneficiaries.

- Lasting Powers of Attorney (LPAs) – Legal authority for trusted individuals to manage your affairs if you lose capacity.

- Business Succession Planning – Guidance for company owners on transferring or protecting business assets.

- Property Planning – Advice on joint ownership, transfer of equity, or protecting property for future generations.

Handled properly, estate planning provides security in life as well as clarity after death.

DIY vs Professional Wills and Probate

The Appeal of DIY

DIY wills and probate services are popular because they are cheap and appear straightforward. Supermarket kits and online templates often cost less than £50. For very small and simple estates, they can sometimes be effective.

The Risks of DIY

However, the risks often outweigh the benefits. Common DIY problems include:

- Incorrect witnessing of the will, making it invalid.

- Ambiguous wording that leads to disputes.

- Failure to account for tax, leaving families with unexpected liabilities.

- Assets being omitted altogether, leading to partial intestacy.

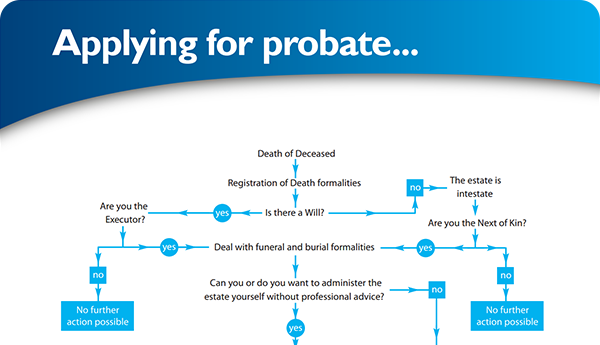

When it comes to probate, executors who go it alone often underestimate the time commitment. Gathering documents, submitting inheritance tax forms, corresponding with financial institutions, and applying for the Grant of Probate can take hundreds of hours. Mistakes can result in costly delays or even personal liability for the executor.

The Professional Advantage

Solicitors provide security, accuracy, and reassurance. They ensure wills are legally binding, personalised, and up to date with current law. For probate, they handle the entire process from start to finish, liaising with banks, HMRC, and the Probate Registry on your behalf.

By choosing wills solicitors in Ware, you also benefit from professional indemnity insurance, which protects your estate against potential mistakes — a safeguard DIY approaches cannot offer.

The Costs of Wills and Estate Planning

Solicitors’ Fees for Wills

- Simple Will: £200–£400 plus VAT.

- Mirror Wills (for couples): £300–£600 plus VAT.

- Complex Wills with Trusts: £500–£1,200+.

Probate Services

- Grant-only service: From £950 plus VAT (solicitor obtains the Grant of Probate, executor handles the rest).

- Full administration: £3,000–£6,000+ depending on estate size and complexity.

DIY Costs

- Will kit: £30–£50.

- DIY probate: Court application fee is £300 if the estate exceeds £5,000, plus additional disbursements.

While DIY may look cheaper, the potential costs of disputes, delays, or invalid documents far outweigh the initial savings. Professional services give families peace of mind that everything is done correctly.

Common Scenarios: DIY vs Solicitor Outcomes

- Case Study 1: A family in Hertfordshire used a DIY will kit. The will was signed incorrectly, leaving the estate to be treated under intestacy rules. The partner of 20 years received nothing and had to pursue a costly legal battle.

- Case Study 2: Executors of a £500,000 estate tried DIY probate but miscalculated inheritance tax, incurring penalties from HMRC. Solicitors had to be brought in to resolve the error, costing far more than if they had been used from the start.

- Case Study 3: A Ware couple instructed solicitors to create mirror wills with trusts. The estate plan reduced their inheritance tax liability by £120,000 and ensured assets passed smoothly to their children.

These examples highlight the long-term value of professional advice compared to the risks of DIY approaches.

Why Choose Wills Solicitors in Ware?

Local expertise matters. Solicitors based in Ware are familiar with the needs of families in Hertfordshire and offer a personalised, accessible service. At The Probate Bureau, we pride ourselves on:

- Transparent, fixed-fee pricing.

- Efficient turnaround, with many estates completed within six months.

- Comprehensive services covering wills, trusts, probate, and estate planning.

- Compassionate support tailored to your circumstances.

We have been trusted by families across Hertfordshire since 1999 and are recommended by over 1,000 funeral directors.

FAQs

- 1. Can I write my own will?

- Yes, but errors are common and can make the will invalid. Solicitors ensure your will is legally binding.

- 2. How often should I update my will?

- It is best to review it every five years or after major life changes such as marriage, divorce, or property purchase.

- 3. What happens if I die without a will?

- Intestacy rules decide who inherits, which may not reflect your wishes.

- 4. How much does probate cost in Hertfordshire?

- Professional fees vary but start at £950 plus VAT for grant-only services.

- 5. Can solicitors help reduce inheritance tax?

- Yes, through trusts, exemptions, and estate planning strategies.

Conclusion

Making a will and planning your estate are vital steps in protecting your family and your assets. While DIY options may appear cost-effective, they often result in disputes, invalid documents, and higher costs in the long run. Professional wills solicitors in Ware provide expertise, reassurance, and peace of mind, ensuring your estate is managed efficiently and in line with your wishes.

At The Probate Bureau, we are committed to delivering clear, fixed-fee solutions that take the stress out of wills, probate, and estate planning. Contact us today to discuss how we can help you protect your family’s future.

Back To BlogShare This Post

Recent posts

- Probate Delays and How to Speed Things Up in 2026 By Admin , 03/02/2026

- Inheritance Tax Planning: 2026 Allowances and Exemptions Guide By Admin , 03/02/2026

- Making a Will at Christmas: Why the Holidays Are the Right Time By Admin , 23/12/2025

2015 Archive

2016 Archive

2018 Archive

2019 Archive

2020 Archive

0 Archive

- December 2 posts

2023 Archive

- July 10 posts

2026 Archive

- February 13 posts

Blog Categories

Find your way through the probate maze

Click here to follow our step-by–step probate process guide

×