Making a Will at Christmas: Why the Holidays Are the Right Time

Making a Will at Christmas: Why the Holidays Are the Right Time

Christmas is traditionally a time for reflection, family gatherings and forward planning. While the festive season is often associated with celebration, generosity and togetherness, it also brings into focus deeper considerations around responsibility, legacy and the future wellbeing of loved ones. For many people, this makes Christmas an appropriate and practical time to consider putting a Will in place.

Although making a Will is something many intend to do “at some point”, it is frequently postponed due to busy schedules, uncertainty about the process or discomfort around discussing mortality. The Christmas period, however, offers a natural pause in the year, providing space to address important personal affairs that are often delayed during everyday life.

Why So Many People Delay Making a Will

Despite a general understanding of the importance of having a Will, a significant proportion of adults in the UK still do not have one. Common reasons include a belief that a Will is only necessary later in life, concerns about cost, or the assumption that estates will automatically pass to family members.

Unfortunately, dying without a valid Will, known as dying intestate, can result in outcomes that differ significantly from what an individual may have intended. Intestacy rules do not account for personal relationships in the way many expect. Unmarried partners may receive nothing, children may inherit at a fixed age regardless of maturity, and the process of administering the estate can become more complex and time-consuming.

Making a Will provides clarity, certainty and legal direction. Christmas, with its focus on family and the future, can be an ideal moment to address this responsibility.

Why Christmas Is a Natural Time to Make a Will

Family Conversations Happen More Naturally

Christmas is one of the few times of year when families are more likely to spend extended time together. While making a Will does not require group discussion, the festive period often prompts reflection on relationships, dependants and future intentions.

For parents and grandparents in particular, Christmas can highlight the importance of ensuring children and vulnerable family members are properly provided for. Seeing family together can naturally prompt consideration of who should benefit from an estate and how best to protect loved ones.

A Time for Reflection and Perspective

The end of the year encourages people to take stock of their lives. Financial reviews, goal setting and future planning often take place during this period. Including estate planning as part of this reflection is both sensible and proactive.

Life events such as marriage, divorce, the birth of children or grandchildren, purchasing property or starting a business can all affect the suitability of an existing Will. Christmas provides an opportunity to ensure that estate planning arrangements reflect current circumstances rather than outdated assumptions.

Practical Advantages During the Holiday Period

Contrary to common belief, making a Will does not need to be disruptive or overly time-consuming. Many people find they have greater flexibility during the Christmas period, making it easier to gather information, consider decisions and seek guidance without the pressures of daily routines.

Starting the process before the new year can also offer reassurance, allowing individuals to enter the next year knowing that their affairs are properly organised.

What a Will Actually Does

A Will is a legally binding document that sets out how your estate should be distributed after your death. It also allows you to make decisions that would otherwise be dictated by law.

A properly drafted Will enables you to appoint executors to manage your estate, decide who inherits specific assets or personal possessions, and nominate guardians for minor children. It can also be used to make charitable donations, provide for dependants and reduce the likelihood of disputes.

Without a Will, these decisions are governed by intestacy rules, which may not reflect personal wishes or family dynamics.

Common Misconceptions About Making a Will

“I Don’t Have Enough Assets to Need a Will”

This is a widespread misconception. A Will is not solely about financial wealth. Personal belongings, savings, digital assets and responsibility for dependants all warrant careful consideration. Even relatively simple estates benefit from clear instructions.

“It Can Wait Until Later”

Life is unpredictable. Delaying the process increases the risk of leaving matters unresolved. Making a Will now does not prevent future changes; it simply ensures protection is in place in the meantime.

“It’s Complicated and Time-Consuming”

With appropriate guidance, making a Will is usually straightforward. Taking time to think through decisions during the Christmas period can make the formal drafting process more efficient and accurate.

Who Should Consider Making a Will at Christmas?

While anyone over the age of 18 can benefit from having a Will, Christmas is a particularly relevant time for individuals who have experienced recent changes. This includes those who are newly married or divorced, parents and grandparents, homeowners, business owners and individuals with blended or complex family arrangements.

Those wishing to leave gifts to charities may also find the festive season a meaningful time to consider how they would like their values reflected in their estate.

Reviewing and Updating an Existing Will

Christmas is not only a good time to make a Will, but also to review an existing one. Circumstances change, and a Will that was appropriate years ago may no longer reflect current wishes or relationships.

Common reasons to update a Will include changes in marital status, the birth of children or grandchildren, changes in financial circumstances, or the need to appoint new executors. Reviewing a Will regularly helps ensure it remains effective and legally sound.

Peace of Mind for the New Year

One of the most significant benefits of making or reviewing a Will is peace of mind. Knowing that your affairs are in order reduces anxiety for both you and your loved ones. It also provides reassurance that your wishes will be respected and that your estate can be administered efficiently.

Making a Will at Christmas allows you to begin the new year with confidence, knowing that an important responsibility has been addressed.

Conclusion

Christmas is a time for generosity, reflection and future planning. Making a Will during the festive period aligns naturally with these themes, offering an opportunity to provide clarity, security and reassurance for loved ones.

Rather than postponing the decision yet again, taking action at Christmas ensures your wishes are formally recorded and your estate is protected. It is a practical and thoughtful step that can have a lasting impact.

Frequently Asked Questions: Making a Will at Christmas

Is Christmas really a good time to make a Will?

Yes. Christmas encourages reflection on family and future responsibilities, making it a natural time to consider estate planning without the pressure of everyday routines.

Can I make a Will during the Christmas holidays?

Yes. The process can often be started during the festive period, allowing you to gather information and make decisions even if the final document is completed shortly afterwards.

Why is it risky to delay making a Will?

Delaying increases the risk of dying without a valid Will, which can lead to unintended outcomes under intestacy rules and additional stress for loved ones.

Do I need a Will if my estate is small?

Yes. A Will provides clarity over personal possessions, executors and guardianship, regardless of the size of the estate.

Can I update an existing Will at Christmas?

Yes. Christmas is an appropriate time to review and update a Will following changes in personal or financial circumstances.

What happens if I die without a Will?

Your estate is distributed under intestacy rules, which may exclude unmarried partners and produce outcomes that do not reflect your wishes.

Can making a Will reduce stress for my family?

Yes. A clear Will reduces uncertainty, helps prevent disputes and makes estate administration more straightforward.

Is making a Will complicated?

In most cases, no. With guidance, the process is clear and manageable.

Can I include charitable gifts in my Will?

Yes. A Will allows you to support charities alongside providing for family and friends.

Is it better to make a Will now rather than wait?

Yes. Making a Will now ensures protection is in place and avoids the risk of further delay.

Back To BlogShare This Post

Recent posts

- Probate Delays and How to Speed Things Up in 2026 By Admin , 03/02/2026

- Inheritance Tax Planning: 2026 Allowances and Exemptions Guide By Admin , 03/02/2026

- Making a Will at Christmas: Why the Holidays Are the Right Time By Admin , 23/12/2025

2015 Archive

2016 Archive

2018 Archive

2019 Archive

2020 Archive

0 Archive

- December 2 posts

2023 Archive

- July 10 posts

2026 Archive

- February 13 posts

Blog Categories

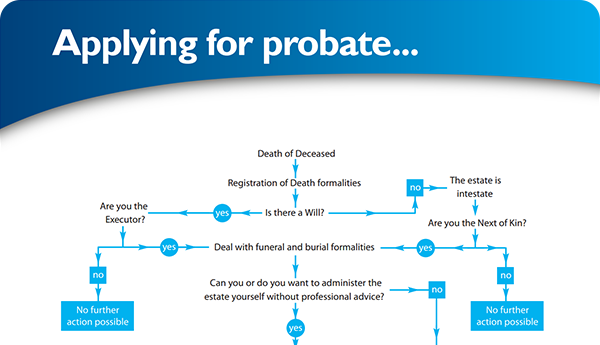

Find your way through the probate maze

Click here to follow our step-by–step probate process guide

×