Wills and Probate News : October 2018

Wills and Probate News : October 2018

Wills and probate experts in Hertfordshire and Essex, The Probate Bureau, have compiled the latest news, advice and guidance on Wills and Probate from around the world.

The Importance of Seeking Legal Advice When Making a Will.

The Law Commission reported that around 40% of people do not have wills, reports Lexology.com

Due to the changing patterns in family life such as partners cohabiting or having second families, making a will is becoming ever more important. Unfortunately, even when a will is made problems can arise if it is not drafted carefully.

Many people believe a DIY will, will be cheap, however, if it is incorrectly drafted, the cost to a person's estate can far outweigh the initial cost had they gone to a professional.

Problems may arise as a result of mistakes in the drafting of the will, the meaning of the will is unclear, or issues with the execution of the will.

The Co-operative Legal Services (CLS) have been reported to suggest that 'poorly drafted or ineffective DIY wills are to blame for a prolonged probate ordeal for 38,000 families a year'. This risks leaving a legacy of financial and emotional strain plus potentially higher legal and tax bills.

60% of People Don't Have A Will.

Over half of UK adults don't have a will, according to research from Unbiased.co.uk, reports yourmoney.com.

This is an all-time high, passing the previous peak in 2011. Over 31 million now run the risk of dying intestate and having their estate distributed solely according to intestacy law. This is a particular problem for those with stepfamilies, or who live together unmarried.

Those aged 55 or over are three times more likely to have a will than those aged 18-34. However, even this age group more than a third (37%) don't have a will. this 35-54 age group are notable laggards. In spite of having dependents and major financial commitments, three quarters have not laid out how they want their assets to be distributed.

Over a quarter (26%) of those surveyed said they plan to make a will later in life. This is 3% higher than last year. One in ten (11%) said they were put off by the cost of writing a will.

Of those who have made a will, individuals expect to leave an average of £227,000 in property and £74,000 in monetary savings when they die. Property assets have steadily increased since 2015, with property assets up by £5,000. However, savings are down by £2,000 from 2016.

Some areas of the UK are less well-prepared than others. Adults in Liverpool are most likely to have made no arrangements, with 73% having no will, closely followed by Nottingham (69%) and Glasgow (68%).

Karen Barrett, CEO and founder of Unbiased, said, "It looks as if people still aren't getting the message. The huge benefits of having a will, and the even bigger risks of not having one, should be far more widely known and talked about. People think that a will is just for the end of their life, and it is - but who knows when that will be?

"It's clear that many people think that they're just not 'rich enough' to need a will. This ignores the fact that a will makes inheritance a far quicker process - do they really want to keep their loved ones waiting longer when that money might be badly needed? It also doesn't take into account the complexity of modern families, which intestacy law simply doesn't address. Children from previous marriages could end up receiving nothing at all."

Why Wills are Important For Young People

Young people always argue that they own no assets to write wills, reports Standard Media. Wills usually states out who will get which assets upon a testator's death.

Liberty Legal Marketing Specialist Faeeza Khan says that denial of mortality is one of the main reasons people neglect a will in financial planning. She adds that people normally don't want to think about the time they will no longer be around.

Young people can have an estate plan which is important because whether single or married, one has belongings and assets which if wise, should be designated in advance.

Creating an estate plan gives young adults an important voice in the event they become incapacitated or pass on earlier than expected.

In case one is incapacitated, a durable power of attorney is important to identify someone who will assume the responsibility to make financial decisions.

Writing a will is just as important as investing in a retirement annuity as early as getting into your professional career.

Sometimes someone may pass on at a tender age and have some little cash in his or her bank account but unfortunately did not stipulate who should be given. This often creates friction in families as everyone fights for a piece.

It is advisable that when you are taking care of your siblings, relatives or parents that you clearly define who takes what.

According to Khan, people should not describe their funeral arrangements in their will.

Writing a will protects the family from so much struggle. The money in the banks can be used to pay your bills and organise for the burial ceremony.

It will also secure your social media accounts. For example, you could be handling serious emails and in the will, you should clarify what you want to be done to the accounts.

To create protections for your kids. This is to make sure that they can be treated well and they are not left under the care of someone you never wanted when you die.

Need Advice?

The Probate Bureau offer financial and inheritance tax advice, Will writing and probate administration services throughout Hertfordshire and Essex. Call a member of our friendly and knowledgeable team today on (freephone) 0808 120 5420

Share This Post

Recent posts

- DIY Probate vs Professional Help By David West , 23/06/2025

- What to Know About International Assets in Your Estate Plan By David West , 20/06/2025

- When Do You Need Probate & When Is It Required? By The Probate Bureau , 26/07/2023

2015 Archive

2016 Archive

2018 Archive

2019 Archive

2020 Archive

0 Archive

- December 1 posts

2023 Archive

- July 8 posts

2025 Archive

- June 8 posts

Blog Categories

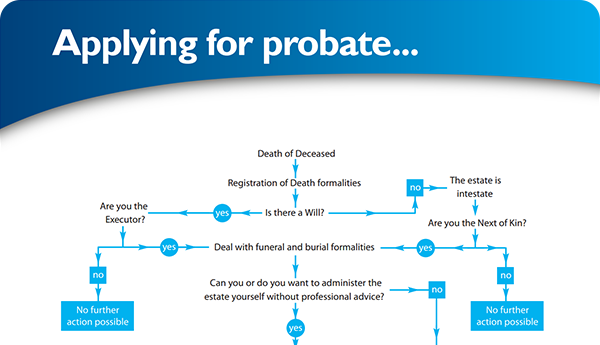

Find your way through the probate maze

Click here to follow our step-by–step probate process guide

×