How Do You Protect Your Digital Assets When You Die?

How Do You Protect Your Digital Assets When You Die?

Writing a will was a reasonably straightforward exercise for our grandparents. When it came to leaving bequests to family or friends, there were tangible assets.

For instance, they may have had a house, a car, jewellery, a treasured stamp collection – it would have been easy to pass those items on to sons and daughters.

But nowadays, we have something new to consider – what do we do about our digital assets?

Can I Bequeath my iTunes Account?

Think about it … while our grandparents had photo albums and collections of vinyl or CDs, we have our photos stored in the cloud and we download our favourite music tracks to our mobile phones. Who owns those photos and that music? And if it is us, how do we bequeath it to a loved one.

And you can also throw money into the mix. Granny and Grandad either kept rolled up notes under the mattress or they had a bank account. Either way, passing it on through their will was easy. But now we have cryptocurrency, and even though the majority of us still don’t understand it, if you hold thousands of pounds in your crypto wallet, you want someone to benefit from it when you die.

The first thing to realise is that what we think are our assets may not be. You know those terms and conditions that pop up on screen whenever we sign up to a new app, and you know how we all just click ‘accept’ because there are a lot of words and all we want to do is be able to save our photos online? Those Ts & Cs hold the key to what we own – and what we have is just a licence agreement with the service provider.

What Is A Digital Asset?

Although there is no legal definition, yet, for what counts as a digital asset, let’s look at some of the obvious ones most of us will have.

Amazon/iTunes: If you have a library of well-loved books on your eReader or a serious back catalogue of Bryan Adams tracks on your PC, the bad news is they are not your assets. You have paid for a licence to be able to read or listen to them, but when you die, that agreement is terminated.

Facebook/Instagram: You can download the content from these accounts. The account can then be either deleted or memorialized and left as a tribute to you. But you will need to tell Facebook in advance who your legacy contact will be. Proof of death will need to be provided.

Twitter: The account can be closed, and they will provide an archive of public tweets. Again, proof of death will need to be provided.

You need to realise that even if you have included in your will for something, say online photos, to be passed on to someone after your death, it may not happen. In iCloud Ts & Cs, for instance, it does say the account is non-transferable and any rights terminate on death.

Of course, you could share your log-in details, so even after your passing your family will be able to access the accounts but telling someone your personal information can be a breach of that user agreement you so casually accepted.

Keep Your Crypto Cash Safe

When it comes to cryptocurrency, there is no legal position when it comes to bequeathing it, other than the fact it CAN be passed on to a loved one.

Similar to your social media accounts, access to your crypto wallet is via a passcode and it is essential you do not lose this. HMRC says: “If an individual misplaces their private key (for example, throwing away the piece of paper it is printed on), they will not be able to access the cryptoasset. The private key still exists as part of the cryptography, albeit it is not known to the owner anymore.”

Essentially, to be able to leave your cryptocurrency to someone, you have to pass on that private key. But do NOT include the code within your will as this will become a public record meaning anyone can gain access to your wallet.

How you choose to save it is entirely up to you, but it goes without saying it must be secure and only accessible by the right people.

Protecting your digital assets is still very confusing. If you have questions or need any guidance, get in touch with us.

Back To BlogShare This Post

Recent posts

- DIY Probate vs Professional Help By David West , 23/06/2025

- What to Know About International Assets in Your Estate Plan By David West , 20/06/2025

- When Do You Need Probate & When Is It Required? By The Probate Bureau , 26/07/2023

2015 Archive

2016 Archive

2018 Archive

2019 Archive

2020 Archive

0 Archive

- December 1 posts

2023 Archive

- July 8 posts

2025 Archive

- June 8 posts

Blog Categories

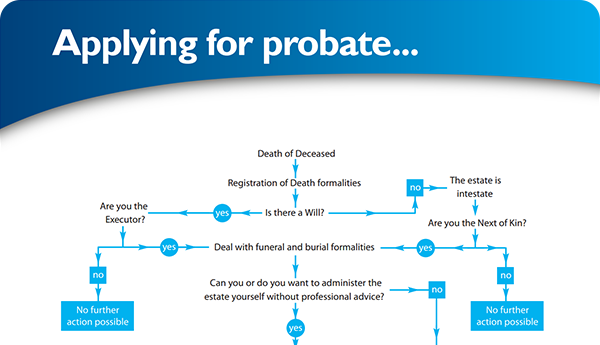

Find your way through the probate maze

Click here to follow our step-by–step probate process guide

×