Why Unmarried Couples Need to Have Wills

Why Unmarried Couples Need to Have Wills

The number of unmarried, cohabitating couples has more than doubled from 1.5 million in 1996 to 3.3 million in 2017. If you are in this situation – not legally married or in a civil partnership – then the truth is, you aren’t entitled to inherit anything when your partner passes away.

Why Do I Need a Will if My Partner and I Aren't Married?

The “Rules of Intestacy” are a set of rules about who will inherit what you own if you pass away without a Will. These rules will have very different effects depending on whether you are or aren’t married.

If you aren’t married or in a civil partnership, then your partner will not be legally entitled to anything when you die.

For example, Jane and Dave live together in a rented flat and have been partners for 35 years. Jane has £90,000 in savings and has a £200,000 life insurance policy from her job. Dave has an estranged sister, Alice, who lives in Australia.

Jane passes away suddenly without a Will. As Jane and Dave were never legally married, the £90,000 and the £200,000 life insurance pay-out will all go to Jane’s closest living relative – Alice in far-flung Australia – therefore leaving Dave with nothing.

However, if you are married or in a civil partnership, then your partner will be entitled to the first £250,000 of what your own, and 50% of what you own above that figure if you have children.

For example, Megan and John are married and don’t have any children. John has £100,000 in his savings account.

John unexpectedly dies and hasn’t got around to making his Will. In this situation, as he’s married to Megan, she will inherit all of the £100,000.

It won’t matter how long you’ve been together, how long you’ve lived together, how many kids you’ve had together if you’re not married or in a civil partnership, you don’t stand to inherit from your partner by law.

What Will Happen to Our Property if My Partner and I Aren't Married?

Whether your unmarried partner will inherit your share of the property depends on the type of ownership. There are two ways of jointly owning a property:

As an unmarried couple registered as tenants in common:

- You can own different shares of the property

- The property doesn't automatically go to your partner if you die

- You need to make a Will if you'd like your partner to inherit your share

For example, Harry and Sarah have been together for 5 years and aren’t yet married. They own a £450,000 flat together in London, with Harry owning 75% of the property.

Though Harry passes away without a Will and due to laws of intestacy, Harry’s share will go to his parents. Even though Harry wanted the property to go to his partner, his parents are legally entitled to the property and force the sale of the flat. Sarah has to move out and doesn’t inherit anything from Harry.

As an unmarried couple registered as joint tenants:

- You have equal rights to the whole property

- The property automatically goes to your partner when you die.

For example, Justin and Laura have been together for 8 years and are engaged (but not yet married). They own a £300,000 flat together in Newcastle as Joint Tenants.

Laura passes away before they get married. As Joint Tenants, even though there is no will, Justin inherits the entire property.

Not too sure how you own your property? Be sure to check your ownership details or find out more about types of ownership. It can be difficult to decipher so call The Probate Bureau if you are in any doubt.

What Happens if an Unmarried Couple Has Children Together?

If you have children together, are unmarried, and die without a Will, then your children will inherit everything you own.

If your children are under 18, then whatever they inherit will be held in a trust for them until they reach adulthood.

While this money can be used for your child’s benefit and education, it does mean that your partner won’t have direct access to what’s held in the trust. If your partner is financially dependent on you, this can cause serious problems for them in terms of what they can afford and their lifestyle.

Next Steps to Ensure That You Have a Legal Will

Here at The Probate Bureau, we have an in-house Will and Trust Department. We are able to offer you a free appointment at your home to discuss the drafting of a Will.

Over the years, we’ve seen many poorly drafted wills which do not fulfil their intended purpose, as well as wills which have been made invalid through lack of legal knowledge. We want to give you the right advice, to ensure that in the unfortunate event of your passing, everything is in order for your family members.

We are members of the Institute of Professional Will Writers and approved by Trading Standards so you can be assured that you will receive professional, reliable advice.

Please feel free to give us a call on 0808 256 2366 to check out what you should do, and most importantly shouldn’t do before you do anything else. The Probate Bureau – Professional, reliable probate service in Hertfordshire.

Back To BlogShare This Post

Recent posts

- When Do You Need Probate & When Is It Required? By The Probate Bureau , 26/07/2023

- Losing a Loved One at Christmas By Probate Bureau , 16/12/2020

- Probate - Your Questions Answered By Probate Bureau , 01/09/2020

2015 Archive

2016 Archive

2018 Archive

2019 Archive

2020 Archive

0 Archive

- December 1 posts

2023 Archive

- July 8 posts

Blog Categories

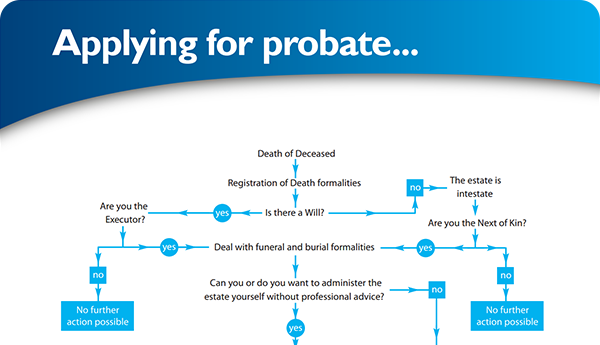

Find your way through the probate maze

Click here to follow our step-by–step probate process guide

×