Wills and Probate News : September 2018

Wills and Probate News : September 2018.

Wills and probate experts in Hertfordshire and Essex, The Probate Bureau, have compiled the latest news, advice and guidance on Wills and Probate from around the world.

Warning Over Wills After Icon’s Death

The news that soul legend Aretha Franklin died without leaving a will has prompted legal experts to warn of the dire consequences for handlings one’s estate that the absence of a will can bring, reports yorkshirepost.co.uk.

Ms Franklin, who died on August 16, left no will for her estimated fortune of around $80 million.

Survived by her four sons, and it’s being reported that her children have filed a report listing themselves as interested parties in her estate.

As the singer’s children have reportedly began proceedings to gain access to her estate, experts have advised that contesting a will and gaining access to property and assets can be difficult to enforce without the correct paperwork in place.

Ben Wilson, associate, contentious trusts and probate solicitor at Forbes Solicitors said: “Failure to leave a will, particularly when there is a substantial estate, as is likely to be the case of Aretha Franklin, can result in substantial sums of money being wasted in disputes between family members, stepfamily and friends of the deceased, warring over the estate.

“The best way to minimise the chances of a dispute is to leave a will, along with a clear letter of wishes, setting out reasons why the Will has been done in this way.”

The Yorkshire Post ran an event last year with the Solicitors for the Elderly organisation, advising on how crucial a will can be to avoiding heartache for loved ones.

Victoria Motley, a specialist solicitor in wills and probate, said: “Making a will gives certainty and peace of mind for everyone.”

“It makes it clear who should be responsible for sorting out your affairs and who you would like to inherit.”

“Failing to make a will at best leaves uncertainty, but more often than not leads to arguments. The law does set out who is responsible for sorting things out and who should inherit where someone doesn’t leave a will, but this does not always give the best result.”

Five-minute guide to... Avoiding disputes over your legacy

ANYBODY can make a mistake, but if you get it wrong when drawing up your will, the consequences can last for the rest of your life and beyond. There are three common mistakes people make when it comes to their will, and any of them can cost your family dear, writes express.co.uk.

The first is writing a DIY will that is riddled with amateur errors, the second is failing to update an existing will and the third is failing to prepare one at all. Do not let any of these be your final testament.

DIY Danger

Growing numbers are writing their own wills using a cheap DIY pack and even handling probate themselves.

However, if you get it wrong, you could bequeath a nasty family dispute when you die.

The number of High Court disputes relating to wills has jumped more than a third in five years and Alison Morris, partner at law firm Wilsons, said: "The growing use of DIY wills and probate is partly to blame."

Morris said that last year almost four out of 10 people executed wills without calling in an expert despite the danger of being sued by family members: "Wills may result in a legal dispute if someone does not think they have been left what they were promised, but may be easier to defend if the process has been carried out properly by a solicitor."

Common reasons for disputes include family members failing to get what they expect, verbal promises not reflected in the will, or the lack of provision for a dependant of the deceased.

Another danger is failing to pay sufficient inheritance tax, which can trigger an investigation by HM Revenue & Customs with penalties, which the executor may be liable to pay from their own pocket.

Morris added: "People understandably want to save some money, but this can lead to major problems, as the increase in legal disputes shows."

Do not make false economies, it pays to have the best will in the world.

Outdated Wills

You also need to update your will after every major life event, such as marriage, divorce, a death in the family or the birth of a child.

Nazia Nawaz, a senior associate at national law firm Irwin Mitchell Private Wealth, warned that failing to do so could be costly as divorce and remarriage become increasingly common: "Wills are rarely updated after big life events, but it can be incredibly expensive to let yours languish with outdated information."

While updating a will can seem costly and time-consuming, the fallout from failing to include second families or additional children is worse. "Disputes can have a devastating effect on families," she added.

Many people do not realise that getting remarried can invalidate a previous will, forcing potential heirs to pursue a claim on death: "Keep your will updated to avoid the stress, cost and fallout from a dispute."

No will no way

The most common mistake, failing to write a will at all, is committed by six in 10 Britons, according to research by Which? Legal.

While 38 per cent told researchers that they have nothing worth inheriting, a third said that either writing a will had not occurred to them or that they were too busy.

Which? Legal managing director Darren Stott said even if you think you have nothing worth inheriting, this is often not the case: "Whatever stage of life you are at, a will offers peace of mind and ensures your money, property and other possessions go to the right place."

Without a will, you cannot decide exactly who gets your assets after your death or ensure adequate provision for your financial dependants.

"Your family could also face additional legal fees, challenges and taxes," Stott said, adding that it is particularly important if you have children under 18 or are cohabiting with an unmarried partner. "Otherwise they may be deprived of their home or your joint wealth, as intestacy rules do not recognise unmarried couples."

If you are making any of these errors, you need to correct them right now. Show a little willpower.

Need advice? The Probate Bureau offer financial and inheritance tax advice, Will Writing and Probate Administration services throughout Hertfordshire and Essex. Call a member of our friendly and knowledgeable team today on (freephone) 0808 120 5420.

Back To BlogShare This Post

Recent posts

- When Do You Need Probate & When Is It Required? By The Probate Bureau , 26/07/2023

- Losing a Loved One at Christmas By Probate Bureau , 16/12/2020

- Probate - Your Questions Answered By Probate Bureau , 01/09/2020

2015 Archive

2016 Archive

2018 Archive

2019 Archive

2020 Archive

0 Archive

- December 1 posts

2023 Archive

- July 8 posts

Blog Categories

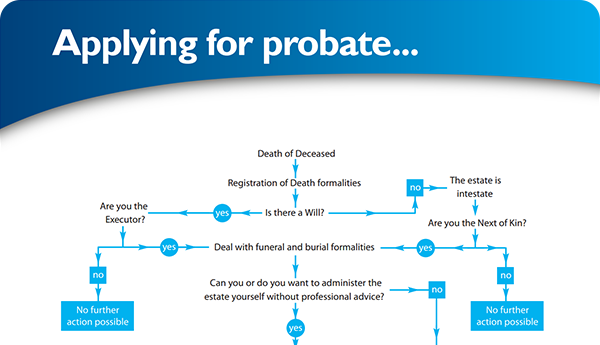

Find your way through the probate maze

Click here to follow our step-by–step probate process guide

×