‘Expensive’ care cap reform delayed until 2020

‘Expensive’ care cap reform delayed until 2020

The government is delaying the implementation of its cap on long-term care until 2020. A letter sent by Alistair Burt, MP for community and social care, has revealed "it is too expensive". The £72,000 care cap was meant to be introduced in April 2016. This will now be delayed by 4 years.

Mr Burt wrote: “The proposals to cap care costs and create a supporting private insurance market were expected to add £6bn to public sector spending over the next five years. A time of consolidation is not the right moment to be implementing expensive new commitments such as this, especially when there are no indications the private insurance market will develop as expected.”

He goes on to say that it was a “difficult decision” to delay the introduction, and that it was “not a decision that has been taken lightly”. The letter also confirmed the delay of the full introduction of the duty on local authorities under the Care Act to meet the eligible needs of self-funders in care homes until April 2020 as well. “The consultation earlier this year highlighted significant concerns about this provision and the extra time will enable us to better understand the potential impact on the care market and the interaction with the cap on care costs system. “We will also now defer the introduction of the proposed appeals system for care and support to enable it to be considered as part of the wider Spending Review that will launch shortly.”

The letter also said that concerns were raised by the Local Government Association as well as the National Audit Office which highlighted concerns around the timetable for delivery. The letter said: “And we will not be complacent: we will work hard to use this additional time to ensure that everyone is ready to introduce the new system. “It will also provide an opportunity for us to continue to work together to consider what else we might do to support people to prepare for later life, including the risk of needing care and support. “For example, the new pension flexibilities that were introduced in April create a real opportunity for us to work with the financial sector to look at what new products may be developed, thereby creating even more choice, and this is something I am keen to explore.”

Mr Burt added that he will be holding an “urgent meeting” with representatives from the insurance industry along with HM Treasury and other government ministers to work through what this announcement means for them and how government can help them to bring forward new products. “These discussions will continue over the summer,” the letter added.

The Probater Bureau Ltd urges you all to consider the implications of the above to you and your family. Planning well ahead is strongly advised.

Back To BlogShare This Post

Recent posts

- When Do You Need Probate & When Is It Required? By The Probate Bureau , 26/07/2023

- Losing a Loved One at Christmas By Probate Bureau , 16/12/2020

- Probate - Your Questions Answered By Probate Bureau , 01/09/2020

2015 Archive

2016 Archive

2018 Archive

2019 Archive

2020 Archive

0 Archive

- December 1 posts

2023 Archive

- July 8 posts

Blog Categories

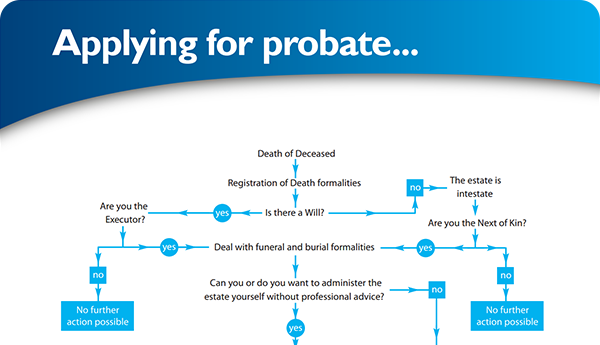

Find your way through the probate maze

Click here to follow our step-by–step probate process guide

×